|

|

The different type of Singapore Company incorporation and which suits you best?

The different type of Singapore Company incorporation and which suits you best?

Once you are convinced that you want to register company in Singapore, it is important that you know the type of company or business entity that you want to incorporate, such as Sole Proprietorship, Partnership, Limited Liability Partnership, or Limited Partnership.

As a home to so many international companies operating in a wide spectrum of industries, the legal framework of Singapore allows for a variety of business structures to get registered and do sustainable and profitable business while ensuring that their diverse needs and requirements are met.

The decision about the type of company you need to incorporate is critical as the type of entity you choose will ultimately determine the key issues such as the liability of owners, transfer ability of business, financing and expansion potential of the business and most importantly the tax and compliance cost of maintaining the entity.

Here are all the important details about types of companies in Singapore so that you can choose the best option that's applicable in your specific situation.

Company

A Company is a company limited by shares i.e. its liabilities are limited to the amount of share capital. A company is incorporated by registering with Accounting and Corporate Regulatory Authority (ACRA) of Singapore under the Companies Act. It is a separate legal entity, meaning there is a legal veil that separates owners from the entity. A company can enter into contracts and own assets. It can sue and be sued in its own name.

The liability of the company is limited to its share capital and each member’s liability is limited to the share capital subscribed by the member (shareholder).

The liabilities of the owners are limited to the assets in the company and their personal assets are protected from business liabilities.

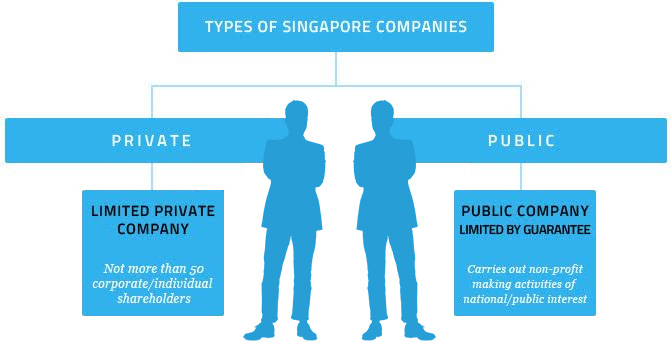

There are 3 types of Company in Singapore:

Private Limited Company (Pte. Ltd.)

Private limited company incorporation in Singapore is the choice of many small and medium size business entities due to several benefits that it offers.

- The shareholders are not held responsible for company debt that surpasses share capital contributed.

- The company’s shares belong to limited people, usually, a few individuals or corporate entities and are not available to the public at large.

- Shares can easily be transferred

- it has easier means to raise capital

- it commands a better credit image than a sole proprietorship or a partnership firm, and investors would usually show more interest in being the part of the company.

In addition to above advantages, there are tax exemptions provided to small and medium size businesses, most of which choose private limited as their choice of company incorporation in Singapore.

Under the Tax Exemption Scheme for New Start-Up Companies, qualified companies are given full exemption on the first $100,000 normal chargeable income* and a further 50% exemption on the next $200,000 of normal chargeable income for the first three consecutive years.

Public Limited Company

Different from a private limited company, the shares of a public limited company are often available to the general public. These companies

will be found in the stock exchange. The number of shareholders is at a minimum of least 50 people. Given that these types of companies

involve the public at large, there are more rules and regulations that avoid exploitation and the misuse of public funds. This option is

best for large businesses.

Public Company Limited by Guarantee

Unlike private and public limited companies, this type of company is mainly setup for a non-profitable purpose. It is conceptually a public company formed along the principle of limiting the liability to the amount that members contribute to the assets of the company.

This set up is common with non-profit organisations.

Types of company structures available for business owners to register company in Singapore

Types of company structures available for business owners to register company in Singapore

Sole Proprietorship

This is the simplest type of company and it’s easiest to incorporate company in Singapore as Sole Proprietorship.

It is however, the riskiest considering that likes of LLC, the owner of a Sole Proprietorship company is seen as part and parcel of the company. They are thus, more liable to suffer risks that arise from the business.

Personal assets and those of the company are under the owner’s name, meaning they are not protected. If the company is in debt, then personal assets are legally not beyond the reach of creditors.

This type of company is best suited for individual shop owners or solo entrepreneurs. It's important that the risks involved in operating such a company are clearly understood before going for registration.

Partnership Company

A partnership company does not exist legally on its own without its partners. Membership ends upon death, retirement or insolvency. There

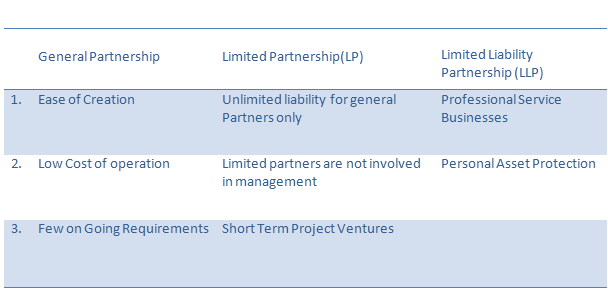

are three types of partnership structures in Singapore: general partnership, limited partnership and limited liability partnership.

General Partnership

This business structure is similar to a sole proprietor. The business partners are personally liable for the business liabilities and debts. The partners share responsibility as one is held accountable for the actions of a fellow partner. It is not the best business structure in Singapore as it contains a lot of risks.

Limited Partnership

In Singapore, this is the most common type of partnership structure in the company. This is because the liabilities are limited to the company’s investments. The risks to all the partner’s personal assets are thus limited to how much they invest into the business. The partners cannot however, manage the business.

Limited Liability Partnership (LLP)

This is basically a structure where a registered LLP gives the partners the freedom to run the business and contribute to its management. This company comes along with benefits similar to those found in a private limited company. This partnership is the best for business where professionals have a joint practice. It requires a great deal of organization and planning beforehand. With this in regard, it more often than not required a lawyer to draw up the agreement between partners involve.

Comparison between General Partnership, LP & LLP company structures

Comparison between General Partnership, LP & LLP company structures

Conclusion

All the business entities and structures are best suitable for different scenarios. A local in Singapore would for instance work best with a Sole Proprietorship if they are the only owner and if the products and services do not present risks and liabilities. If you are a professional who is looking for starting a business with several partners in your field, then you can consider a Limited Liability Partnership. The best choice for a lot of business people and Entrepreneurs is a private limited company set-up.

Have questions about company incorporation in Singapore? Contact us and we will be glad to help you successfully and quickly register company in Singapore ensuring that you comply with all local laws, while making sure that you achieve your business goals.