|

|

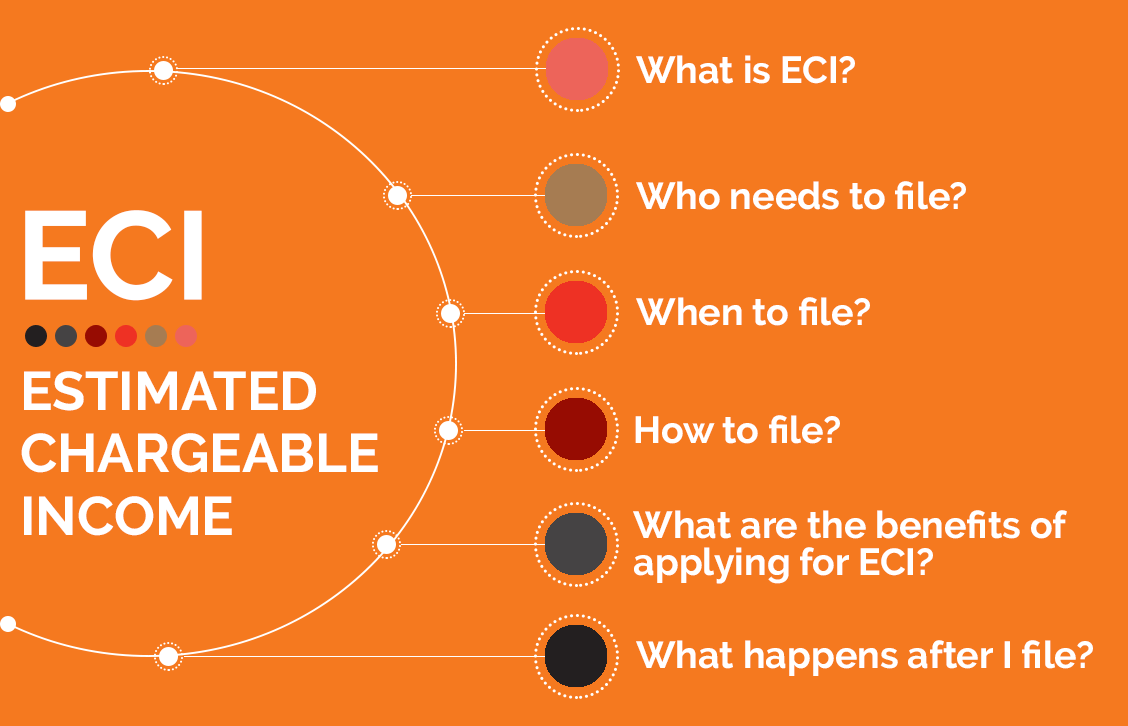

Everything You Need To Know About ECI In Singapore

If you have questions about Estimated Chargeable Income in Singapore (ECI), you're in the right place. In this article, we'll discuss everything there is to know about ECI in Singapore, and why your business should be filing for ECI. Let's get started now, beginning with the basics about ECI.

UNDERSTANDING THE BASICS OF ECI (ESTIMATED CHARGEABLE INCOME)

Estimated Chargeable Income, or ECI for short, is the estimate of the total taxable income for your company, during any given Year of Assessment, or YA.

It is calculated based on your total income, minus all tax-allowable expenses and other such deductions.

The IRAS (Inland Revenue Authority of Singapore) requires that

ECIs be filed so that they can raise an early assessment of corporate performance, and use this information to help the Singaporean

government track business health from a macro level. Essentially, it helps to track the financial performance of Singapore and its

businesses and ensures that your company is being taxed properly.

ECI must be filed every year for every company, except if you are exempt due to waivers which we will discuss in further detail below.

Failing to file an ECI when you are required to by law will result in the IRAS releasing a Notice of Assessment, or NOA, based on their own

estimation of your company’s income. Failure to object to this assessment will result in the NOA being recognised as final.

who needs to file for eci?

The Singaporean Government announced new ECI regulations for Budget 2016, which will result in every company being required to submit and file ECI estimations. The time-table for compulsory filing is as follows:

- 2018 – Companies with more than $10 million in revenue must file for YA 2017

- 2019 – Companies with more than $1 million in revenue must file for YA 2018

- 2020 – All companies of all sizes must submit ECI to the IRAS

Even if your company has an ECI of “NIL” for the YA in question – that is, you made no profits or your company is dormant – you still must file an ECI. The only exceptions are if your company is:

- A foreign ship owner or charterer, for whom a Shipping Return will have already been submitted by a shipping agent.

- A Foreign university A designated unit trust, or approved CPF unit trust.

- A Real Estate Investment Trusts (REITs) granted special tax treatment under the Income Tax Act’s section 43(2).

- Specially granted a waiver from furnishing ECI by the IRAS – such as via an advance ruling.

You can learn more about these exceptions and exemptions on

the IRAS website.

To see if you must file, you can use the New

Company Start-Up Kit from the IRAS.

WHEN DO I NEED TO FILE FOR ECI?

Every company needs to file its ECI within 3 months after the end of its financial year, with no exceptions. In some cases, you may be able

to get an extension from the IRAS, but you should still always plan to file ECI within 3 months of your financial year ending.

It's beneficial to file electronically as soon as you can. If you happen to get stuck in the process or need guidance , Precursor is here to help. We're always standing by to assist you and we can answer any questions you may have. Get in touch and schedule an appointment right away!

HOW DO I FILE MY ECI?

E-filing of ECI is compulsory, starting after YA 2018 – so your company is encouraged to begin the e-filing process early.

To begin, simply visit mytax.iras.gov.sg. Then, you will need to ensure that you have the following:

- Approval and authorisation from your company as the “Approver” for Corporate Tax in CorpPass

- Your company’s Tax Reference Number

- Your CorpPass ID and password

E-filing is recommended, because it will result in the fastest processing times, and provide your company with a larger number of

instalments, through which it can make its estimated tax payments.

what are the benefits of applying eci and filing for small businesses?

ECI will eventually be mandatory for businesses of all sizes – but even before this happens, there are a number of good benefits of applying ECI, particularly for SMEs.

The biggest reason is the Corporate Income Tax (CIT) rebate on your ECI. For the Year of Assessment (YA) 2019, companies are granted a 20% CIT tax rebate, based on their corporate tax payable.

This is limited to a cap of $10,000 – so while this rebate may not be useful for a multi-billion dollar international company, it can be extremely helpful for smaller businesses, for which each tax break can make a big difference.

In addition if you file early, you will have a greater number of instalments with which you can pay your company's estimated tax, as follows:

- ECI filed 1 month from financial year end – 10 instalments for e-file, 5 for paper filers

- ECI filed 2 months from financial year end – 8 instalments for e-file, 4 for paper filers

- ECI filed 3 months from financial year end – 6 instalments for e-file, 3 for paper files

- ECI filed 3+ months from financial year end – NO INSTALMENTS ALLOWED

what happens after i file?

Once the IRAS has processed your form, you will receive your Notice of Assessment, which will inform you of the total amount of tax that is to be paid by your company. This tax must be paid within one month from the issue date of the NOA, unless you are participating in the GIRO instalment plan.

You will be sent information about the various ways to pay after your filing has been accepted, and your NOA issued. You can view your NOA

at mytax.iras.gov.sg after you have filed your ECI and received your NOA.

Confused? Need Help Getting Started?Contact Precursor Right Away!

At Precursor, we specialise in accounting, audit, and taxation in Singapore. If your SME is going to be required to file ECI in the upcoming YA, we are here to help. We can help you understand how ECI works, how to minimise your tax liabilities, when and how to file, and much more.