|

|

All you need to know about Singapore branch office registration

All you want to know about Singapore branch office registration

When incorporating company in Singapore as a foreign individual/entity, one of the company registration options in Singapore that is used by

businesses is Singapore branch office registration.

This is one of the 3 company incorporation options that are available to foreigners, while other two options are Singapore subsidiary and

representative office.

if you choose to incorporate a branch office in Singapore, This post is intended to provide all that you would like to know about Singapore

branch office registration, so that the process of company incorporation in Singapore can be smoothen for you by taking informed choices and

decisions.

What is Singapore branch office

In Singapore, any activity with the purpose of profit making, if running on continuing basis needs to be registered with the Accounting and

Corporate Regulatory Authority (ACRA). This also applies to foreign companies that are looking to open their branch office in Singapore.

The Singapore branch office is an extension of a foreign company in Singapore, that must carry the same name as the parent company where the

parent company of a branch office entity is implicitly liable for all the debts and liabilities of the branch office. In the case of any

dispute, a claimant can approach the Singapore courts of law to initiate legal proceeding against the headquarters, by virtue of its branch

being located in the Singapore jurisdiction.

Singapore branch office is considered a non-resident for tax purposes, and therefore not eligible for tax incentives and exemptions

available to Singapore private limited companies.

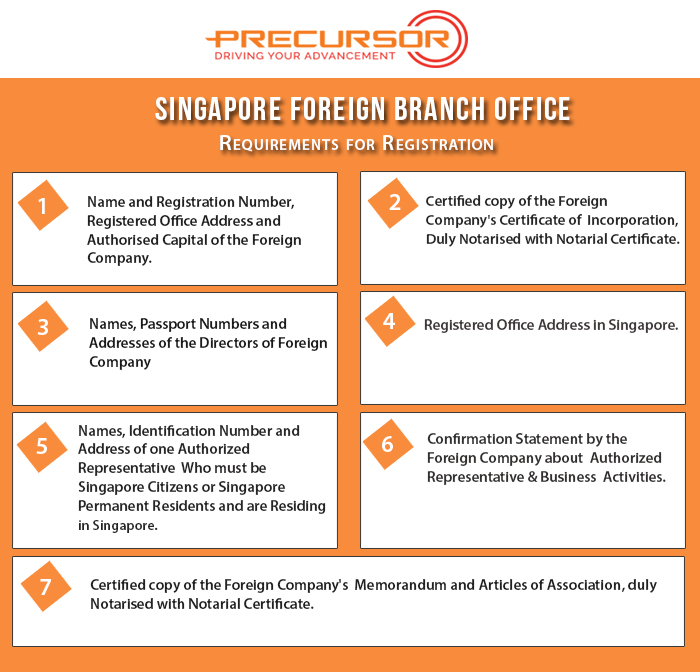

Requirements for registering Singapore branch office

One of the most critical and crucial requirements while a foreign company wanting to register branch office in Singapore is to have a

reputable corporate service firm in Singapore.

There are several documents that you need to provide for the incorporation process to take place:

- The name and address of the company’s registered office where it is incorporated. This has to be the address of parent company that is willing to open the Singapore branch office.

- Certificate of incorporation or any similar document (certified copy)

- Any document stating the charter, statute, the constitution of the company (certified copy). This document is to be submitted only if it is required by the law of the place of incorporation of the foreign company, at the time of incorporation and registration.

- A register of the directors specifying the list of all the directors and the same details as outlined by Singapore companies act. The residential address of each of the directors should be mentioned.

- A notice with the name, nationality, residential address and other identification details, as required, of the authorised representatives of the company who reside in Singapore.

- A confirmation statement by the foreign company that the authorized representative has provided his or her consent to act in that capacity.

- A notice stating the situation of the registered office as in Singapore. If the office in Singapore is not open during the usual business hours and days, the days and hours it will be open for public access should be specified.

- In case the law of the foreign company’s country of incorporation requires the preparation of the audited financial statement, a copy of the same should be furnished to the Registrar.

- A notice stating the following:

- The registration number as issued to the foreign company either on its incorporation certificate or a similar document. If the company does not have any document, the registration number issued by the authority responsible for the company’s incorporation should be stated.

- The kind of business carried out by the foreign company.

- The legal form of the foreign company.

Note: There may be other things and documents that are required in addition to the ones described above. This can best be informed by your

corporate services firm that is handling the process.

Registration process for a Singapore branch office setup

A good corporate services firm in Singapore will be able to assist you on the steps on registering a Singapore branch. In fact, when it

comes to opening of corporate bank account with some local banks, foreign directors are not required to physically visit Singapore in some

cases. However, most local banks require foreign directors to be present during the opening of corporate bank account.

If you have prepared all the documents and underwent the procedures timely, Singapore branch office registration is usually quick and can be

completed within a few days.

Tax and liabilities for a Singapore branch office setup

A Singapore branch office of a foreign company is considered non-resident and the complete liabilities are imposed on the respective parent

company of such a Singapore branch office.

Having considered non-resident, Singapore branch office is not eligible to most tax benefits, incentives, government funding and other

advantages that are offered to Singapore private limited companies. However, they may still be treated as Singapore tax residents if they

are able to satisfy IRAS that certain conditions have been met. For details on the conditions, refer to Applying

for COR for Non-Singapore Incorporated Companies.

At Precursor, we provide a full suite of the highest quality corporate services including company incorporation in Singapore,

corporate secretariat in Singapore, accounting and so many others. We have a long list of highly satisfied multinational companies as our

clients, and we take pride to serve them, following our highest quality professional standards and as well as domain expertise.