|

|

Corporate Solutions & Advisory

Corporate Solutions Advisory

We seek to partner our clients in areas of funding, restructuring and mergers and acquisitions

Corporate Funding

Restructuring

Mergers & Acquisition

Valuations

Corporate Funding

Every business goes through a business life cycle and at each stage of business life cycle, business owners are faced with plenty of challenges as well as potential opportunities.

With a good business idea, the availability of ready funding is critical to the survival of all start-ups. In terms of getting available funding, we can assist our clients by tapping into our network of global capital partners such as international banks, investment and trade finance firms and venture capitalists to access to various avenues of funding such as corporate loans, equity funding or mezzanine funding etc.

Restructuring

Not every profitable business venture is a successful corporation, but every successful corporation is a profitable business venture. Often, business owners have an excellent business proposition but they lack the knowledge to build a sound structure or foundation to support their business.

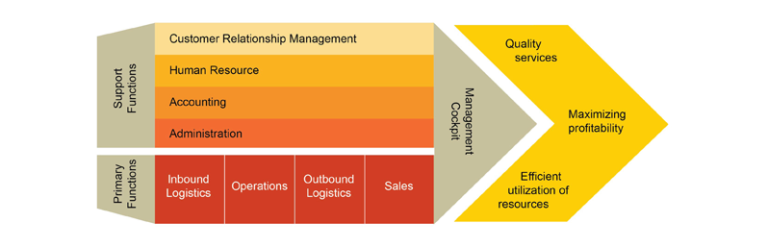

Our team possesses the expertise in the areas of operation processes and control, human resource and information technology. We will carry

out a detailed analysis on the primary and support functions of the business and present the facts and findings to the management, together

with the proposed recommendations.

After the proposed recommendations have been endorsed and implemented, we will carry out a post-mortem review to further refine any key areas which need to be improved, and present to the management a summary of findings to compare the differences between the pre- and post- implementation period.

Mergers & Acquisition

We look for solutions that enables your company to grow faster or become more efficient in the long run by securing you with the right potentials.

Mergers and acquisition is a key option evaluated by many business owners when it comes to expanding their businesses. We can assist our clients to identify suitable targets through our established network of contacts.

Similarly, we can assist clients who wish to exit their businesses in identifying suitable buyers with the aim of achieving the maximum offer price.

Valuations

At Precursor, our team expert uses their valuation skills, professional judgment and commercial experience to value the business and its subject

Our valuation exercise considers all aspects of the business and the transactions, ranging from the Company’s assets to the market conditions and its risk environment.

Using sound financial modelling techniques such as the Capital Asset Pricing Model, going concern valuations, fair value and even the owner

values, we look to maximize your economic potentials and also suit the objective of the assessment.

Through this in-depth understanding of your business and its environment, we will devise a solution that will value-add your opportunities

and provide you with a solid solution.

We provide a full range of business valuation services for the following needs but not limited to:

- Purchase or sale of closely held business or business interests

- Leveraged buyout transactions

- Financial restructuring and recapitalization

- Analysis and advice concerning pending offers to purchase

- Valuation of subsidiaries, divisions and Company Buy/Sells for spin-off to shareholders and/or sale

Learn how Precursor can help your business. Sign up today!